How to Create Bitcoin Logarithmic Price Scale Using Matplotlib

Get Data

Before we can plot the figure, we need to get the data. Again, I am going to use Catalyst to collect Bitcoin price and volume data from Bitfinex.

Start your Jupyter Notebook or JupyterLab, and create a new file.

First, let us import some modules.

# Make interactive plots in JupyterLab

# If you would like to know more, check this post of mine

# https://0xboz.github.io/blog/how-to-create-interactive-plots-in-jupyterlab/

%matplotlib widget

from catalyst.api import symbol, record

from catalyst import run_algorithm

import matplotlib.pyplot as plt

import matplotlib.dates as mdates

from matplotlib import style

from matplotlib import ticker

import numpy as np

import pandas as pd

Next, we need to define a few variables, which will make our life easier when switching to another trading pair or changing some params.

trading_pair = 'btc_usd'

# Catalyst has collected more than 4 years BTC/USD daily and minute data from Bitfinex

exchange = 'bitfinex'

start = '2015-3-2'

end = '2019-6-25'

# We are using the daily data in this tutorial

frequency = 'daily'

capital_base = 1000

quote_currency = trading_pair.split('_')[1]

As usual, we start with initializing the function and tell Catalyst which trading pair we are going to use.

def initialize(context):

context.asset = symbol(trading_pair)

Then we deploy handle_data() function and record price, volume and other data on the fly. Please note handle_data() runs every minute, it is recommended to use schedule function instead if your algo doesn’t need that luxury computation. Later you can shorten the time window (say a few weeks) and try it out with frequency = 'minute' and tell me what you have found in case your computer doesn’t crash.

def handle_data(context, data):

# The last known price and volume of current date/minute and the day/minute before

if frequency == 'daily':

previous_price, current_price = data.history(

context.asset, 'price', 2, '1d')

volume = data.current(context.asset, 'volume')

elif frequency == 'minute':

previous_price, current_price = data.history(

context.asset, 'price', 2, '1T')

volume = data.current(context.asset, 'volume')

# Calculate rate of return

simple_return = current_price / previous_price - 1

# Calculate log return

log_return = np.log(current_price) - np.log(previous_price)

record(price=current_price, simple_return=simple_return, log_return=log_return, volume=volume)

One more thing, let us set up __name__ == '__main__'.

if __name__ == '__main__':

perf = run_algorithm(capital_base=capital_base,

data_frequency=frequency,

initialize=initialize,

handle_data=handle_data,

exchange_name=exchange,

quote_currency=quote_currency,

start=pd.to_datetime(start, utc=True),

end=pd.to_datetime(end, utc=True))

Awesome! But before we run our algo, we need to ingest the data first.

(venv) catalyst ingest-exchange -x bitfinex -f daily -i btc_usd

Just in case you would like to run it on minute data, don’t forget to run this command.

(venv) catalyst ingest-exchange -x bitfinex -f minute -i btc_usd

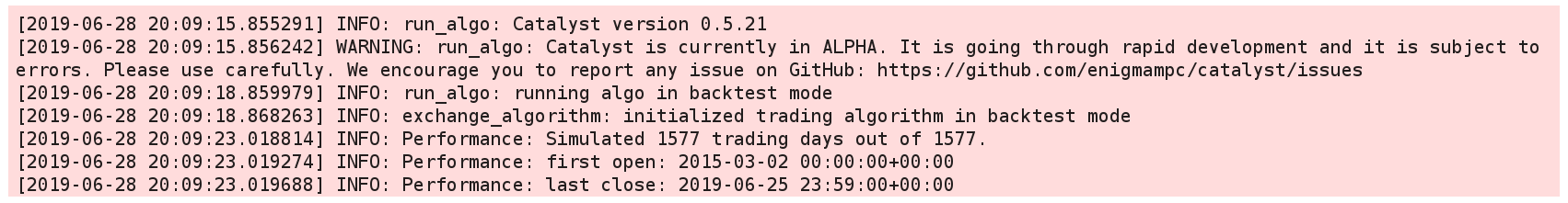

Okay, now let us go back to our coding cell and run the script by Shift + Enter or Ctrl + Enter. If you happen to see the following, meaning we can move onto the next step - plotting!

Matplotlib

Since we have already imported matplotlib, let us jump right into plotting this time.

# Plot style and figure size

style.use('fivethirtyeight')

fig = plt.figure(figsize=(12,18))

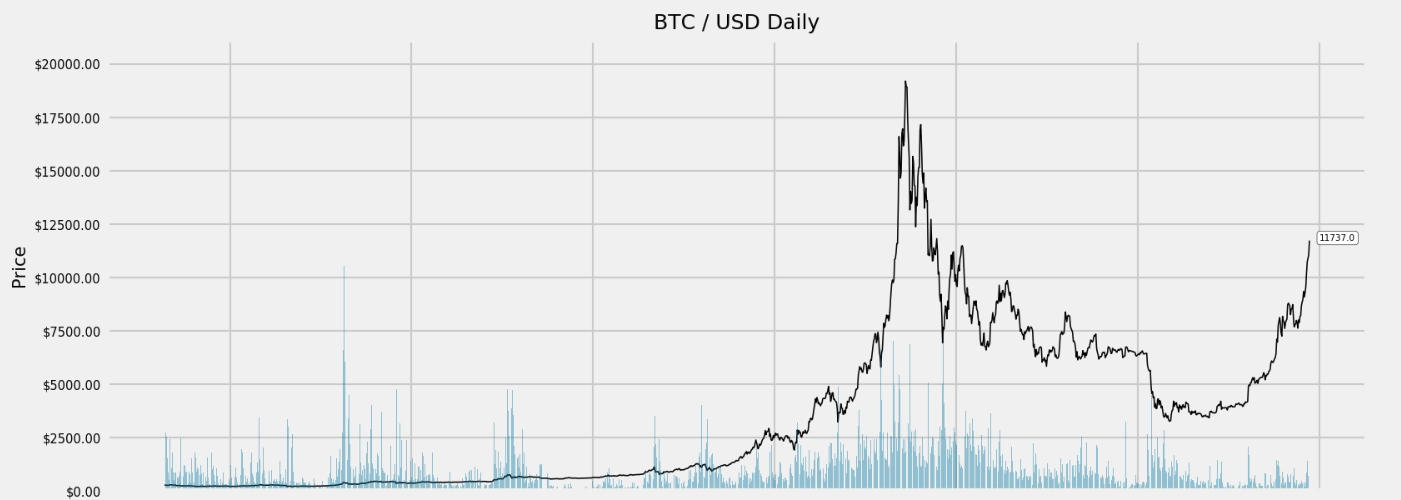

Okay, now the fun part begins. First, we are going have plot a regular price chart for Bitcoin.

# Price Chart

ax = plt.subplot2grid((20, 1), (0, 0), rowspan=7, colspan=1)

ax.plot(perf.index, perf.price, color='k', linewidth=0.75)

ax.yaxis.set_major_locator(plt.MaxNLocator(10))

ax.yaxis.set_major_formatter(ticker.FormatStrFormatter('$%.2f'))

ax.yaxis.set_minor_formatter(ticker.FormatStrFormatter('$%.2f'))

ax.set_ylim([0, np.max(perf.price) * 1.1])

plt.ylabel('Price', fontsize=10)

plt.yticks(fontsize=7)

title = (' / '.join(trading_pair.split('_'))).upper() + ' ' + frequency.title()

plt.title(title, fontsize=12)

plt.grid(which='minor')

plt.setp(ax.get_xticklabels(), visible=False)

bbox_props = dict(boxstyle='round',fc='w', ec='k',lw=0.25)

ax.annotate(str(perf.price[-1]), (perf.index[-1], perf.price[-1]),

xytext = (perf.index[-1] + pd.Timedelta('14d'), perf.price[-1]),

bbox=bbox_props, fontsize=5)

And here is the volume part.

# Volume in Price Chart

axv = ax.twinx()

axv.set_ylim([0, np.max(perf.volume) * 2])

axv.bar(perf.index, perf.volume, color='#0079a3', alpha=0.4)

plt.grid(False)

plt.setp(axv.get_yticklabels(), visible=False)

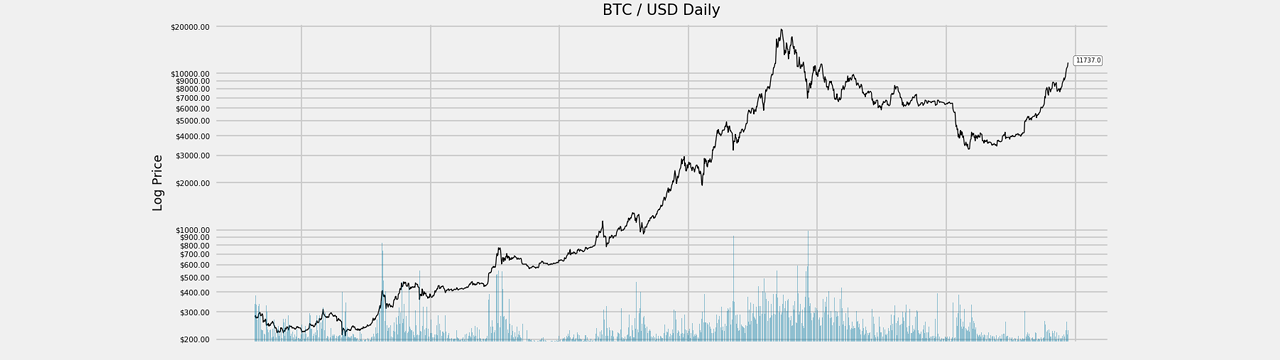

Thanks to matplotlib, it is quite easy convert price to logarithmic scale from the code above.

# Log Price Chart

ax1 = plt.subplot2grid((20, 1), (7, 0), rowspan=7, colspan=1, sharex=ax)

ax1.semilogy(perf.index, perf.price, basey=10, color='k', linewidth=0.75)

ax1.yaxis.set_major_formatter(ticker.FormatStrFormatter('$%.2f'))

ax1.yaxis.set_minor_formatter(ticker.FormatStrFormatter('$%.2f'))

ax1.set_ylim([np.min(perf.price) * 0.9, np.max(perf.price) * 1.1])

plt.ylabel('Log Price', fontsize=10)

ax1.tick_params(axis='y', which='both', labelsize=6)

plt.grid(which='minor')

plt.setp(ax1.get_xticklabels(), visible=False)

bbox_props = dict(boxstyle='round',fc='w', ec='k',lw=0.25)

ax1.annotate(str(perf.price[-1]), (perf.index[-1], perf.price[-1]),

xytext = (perf.index[-1] + pd.Timedelta('14d'), perf.price[-1]),

bbox=bbox_props, fontsize=5)

plt.title(title, fontsize=12)

# Volume in Log Price Chart

ax1v = ax1.twinx()

ax1v.set_ylim([0, np.max(perf.volume) * 2])

ax1v.bar(perf.index, perf.volume, color='#0079a3', alpha=0.4)

plt.grid(False)

plt.setp(ax1v.get_yticklabels(), visible=False)

Here is what it looks like.

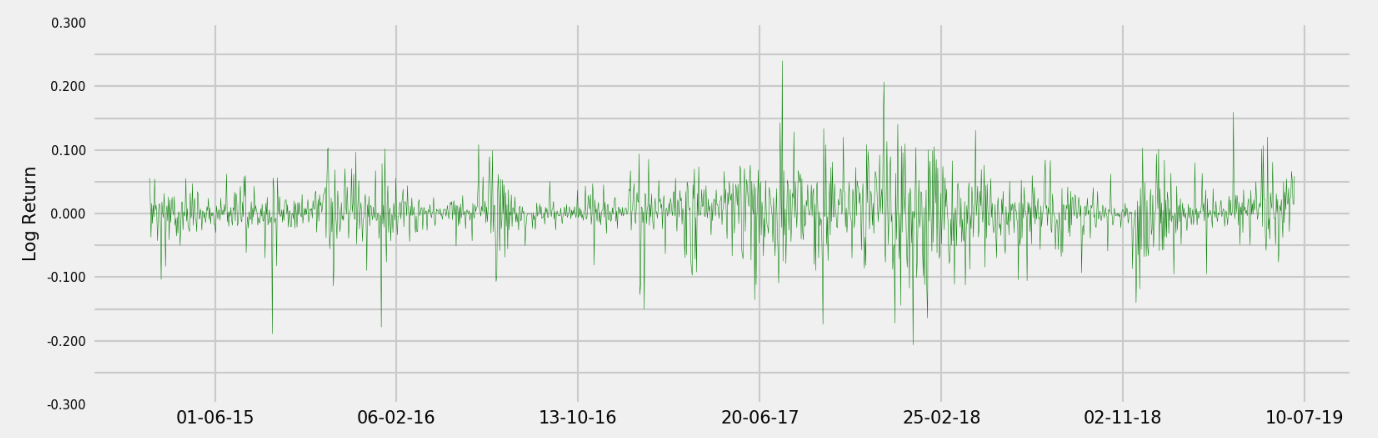

As a bonus, let us re-visit the discussion about Stationarity and Differencing on crypto trading data. The code below is going to generate daily log return time series chart.

# Log Return Chart

ax2 = plt.subplot2grid((20, 1), (14, 0), rowspan=6, colspan=1, sharex=ax)

ax2.plot(perf.index, perf.log_return, color='g', linewidth=0.25)

ax2.xaxis.set_major_locator(plt.MaxNLocator(7))

ax2.yaxis.set_major_formatter(ticker.FormatStrFormatter('%.3f'))

ax2.set_ylim([-0.3, 0.3])

ax2.yaxis.set_minor_locator(ticker.AutoMinorLocator(2))

plt.ylabel('Log Return', fontsize=10)

plt.yticks(fontsize=7)

plt.xticks(fontsize=10, rotation=0)

plt.grid(which='minor')

xfmt = mdates.DateFormatter('%d-%m-%y')

ax2.xaxis.set_major_formatter(xfmt)

From the chart above, we can observe the mean and variance are relatively constant over time. In the upcoming post, I will cover how to utilize this data with integration of order zero I(0) for our trading model.

We still need a few more lines of code to adjust those sub plots.

plt.subplots_adjust(left=0.1, bottom=0.05, right=0.94, top=0.96, wspace=0.2, hspace=1)

plt.show()

Send me a message if you have any questions/comments. Feel like stopping by and say hi? Let us talk more about crypto and quantitative trading over there. Here is the discord invite link.

Stay calm and happy trading!